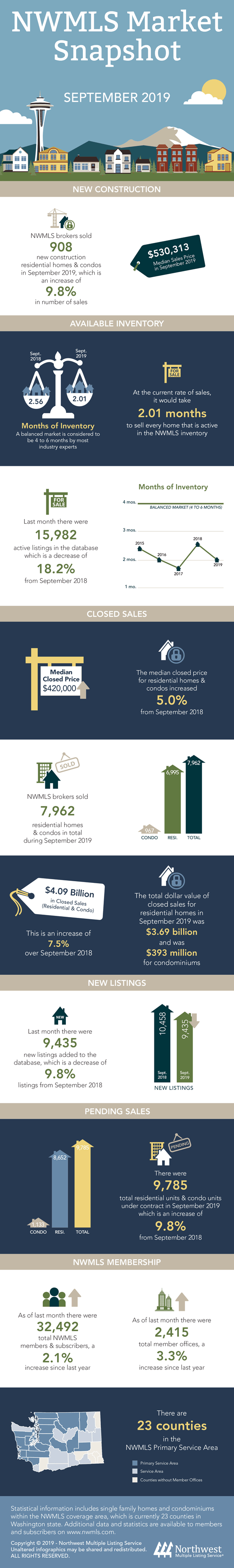

The number of active listings at the end of September was down more than 18 percent from a year ago according to the latest NWMLS Market Update. King County accounted for nearly a third of the region’s total drop in inventory with almost 1,000 fewer homes on the market compared to 2018.

In addition to dwindling inventory, King County’s median price fell nearly 2.7 percent year-over-year to $593,750—dropping below $600,000 for the first time since January. In Seattle, the median for single family homes was down 3.23 percent to $750,000, while the median for condos was down almost 12 percent to $455,000. On the Eastside, the median was up 3.75 percent to $830,000.

Despite the drop in King County, markets surrounding it and along the I-5 corridor between Puget Sound and Portland remain on the rise as buyers continue seeking value and more affordable neighborhoods.

Excluding condos, there is a $275,000 difference between the median single-family home in King County and Pierce County. Pierce County’s median price rose more than 10 percent in September from $345,000 in 2018 to $379,950 this year.

Meanwhile, Pierce’s inventory decreased from 2.01 months to 1.43 months—continuing the trend of demand outweighing the ability to replenish supply.

As for the rest of the 4-county Puget Sound region (which includes King, Snohomish, Pierce and Kitsap), Kitsap County’s inventory was down nearly 25 percent as the median price rose 8.17 percent to $384,000 year-over-year; and Snohomish’s inventory dropped below 2 months as the median price rose 2.58 percent to $470,000.

Something to keep an eye on as the year comes to an end are possible changes to the calculation of to the Washington State Real Estate Excise Tax (REET) from a flat rate to a graduated scale. Currently, the state tax rate is 1.28 percent of a property’s full selling price. The new proposal will:

- Reduce tax to 1.1 percent on sales of property less than $500,000

- Maintain the 1.28 percent tax for properties sold between $500,000 and $1.5 million

- Increase tax to 2.75 percent for properties sold between $1.5 million and $3 million

- Properties sold over $3 million will be taxed 3 percent of the selling price

If signed by the governor, changes would be effective January 1, 2020.